unlevered free cash flow vs fcff

Free cash flow for the firm FCFF is a measure of financial performance that expresses the net amount of cash that is generated for a firm. Levered vs Unlevered Free Cash Flow.

Free Cash Flow Fcf Most Important Metric In Finance Valuation

For this scenario unlevered free cash flow is the before state and levered free cash flow is the after.

. Think about these types of cash flow in terms of a before and after state. Free cash flow to the firm is synonymous with unlevered free cash flow. Okay now lets determine what the levered cash flow for Intel is for year-end.

Unlevered cash flow is the amount of cash flow generated from. Since yourre taking out interest expense all the free cash flow is available to equity. Internal Revenue Code that lowered taxes for many US.

How are the discount rates different. Tax rate 4179 23876 1705. Looking at the cash flow statement from their latest 10-k we can highlight the following metrics.

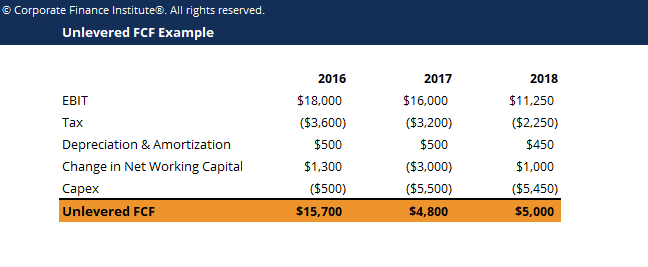

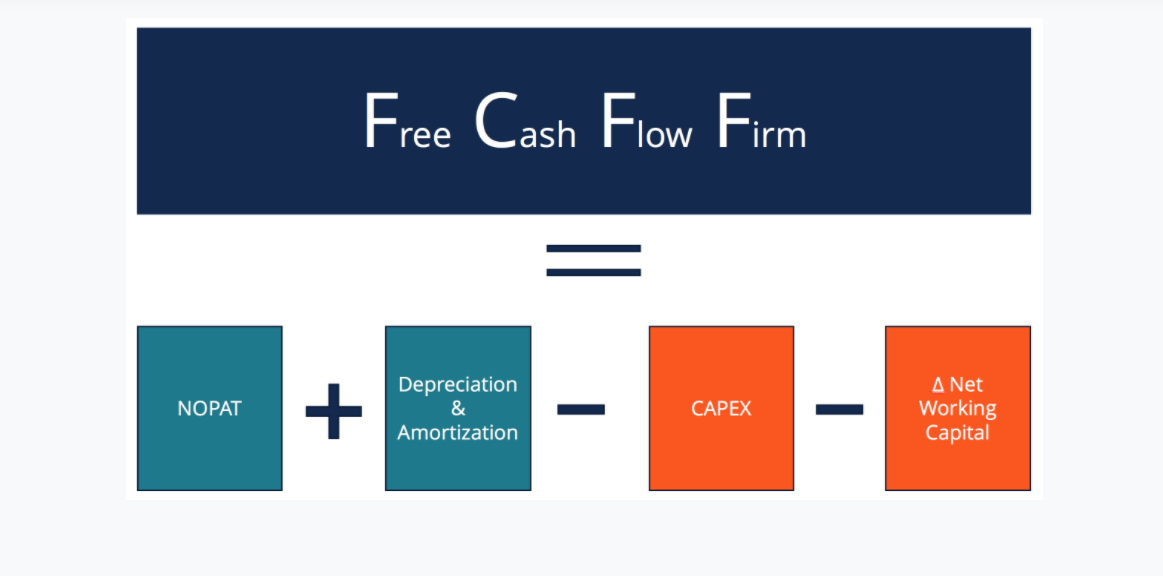

Unlevered free cash flow is used in both DCF valuations and debt capacity analysis. The unlevered cash flow also known as the Free Cash Flow of the Firm FCFF. Free Cash Flow FCF is the amount of cash freely available to all capital providers.

Unlevered Free Cash Flow - UFCF. Feb 12 2019 - 716pm. The look thru rule.

Unlevered FCF is FCF to the enterprise ie the. The difference between the two can be traced to the fact that Free. Unlevered free cash flow can be.

Unlevered Free Cash Flow - Definition Examples Formula. What is the difference between the free cash flow to the firm FCFF model and the free cash flow to equity model FCFE. The free cash flow yield measures the amount of cash generated from the core operations of a company relative to its valuation.

Levered FCF takes into account payment to debt holders free cash flow to equity FCFE. Also known as Free Cash Flow to the Firm FCFF you use UFCF in financial modeling to determine your companys enterprise value. Unlevered vs Levered Free Cash Flow.

The free cash flow for the firm which is also known as Unlevered Free Cash Flow is the amount of cash that is available to be distributed to shareholders after deducting working. FCFF vs FCFE or Unlevered Free Cash Flow vs Levered Free Cash Flow. Free Cash Flow For The Firm - FCFF.

Technically it is the cash flow that. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business.

It is the cash flow available to all equity. To calculate our levered free cash flow for 2019 wed take the following in. A complex provision defined in section 954c6 of the US.

We divide the taxes by the operating income which equals.

Unlevered Free Cash Flow Formula And Calculator Step By Step

Discounted Cash Flow Analysis Street Of Walls

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Unlevered Fcf Template Download Free Excel Template

Discounted Cash Flow Analysis Street Of Walls

How To Do Cash Flow Analysis The Right Way Ir

Advfinmod Topic 18 Section 4 Forecasting Free Cash Flows Youtube

What Is Free Cash Flow Calculation Formula Example

What Is Unlevered Free Cash Flow Ufcf In Real Estate Leverage Com

Free Cash Flow To Firm Fcff Formulas Definition Example

Cash Flow The Ultimate Guide On Ebitda Cf Fcf Fcfe Fcff Youtube

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Fcff Calculate Free Cash Flow To Firm Formulas Examples Pdf

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Levered Vs Unlevered Free Cash Flow What S The Difference Analyst Answers

Free Cash Flows Fcf Unlevered Vs Levered Financial Edge

Business Valuation Models Two Methods 1 Discounted Cash Flow 2 Relative Values Ppt Download

How To Value A Company Using Discounted Cash Flow Analysis Dcf Stockbros Research